What is GST return?

Every person registered under GST Act has to periodically furnish the details of sales, purchases and tax paid and collected theron by filing return with GST Authorities. Before filing any return payment of tax due is pre requisite otherwise such return will be invalid.

Steps for filing GST return:

Eliminating cascading effect of taxes.

Tax rates will be comparatively lower as the tax base will widen.

Seamless flow of Input tax credit.

Prices of the goods and services will fall.

Efficient supply change management.

Promote shift from unorganised sector to organised sector.

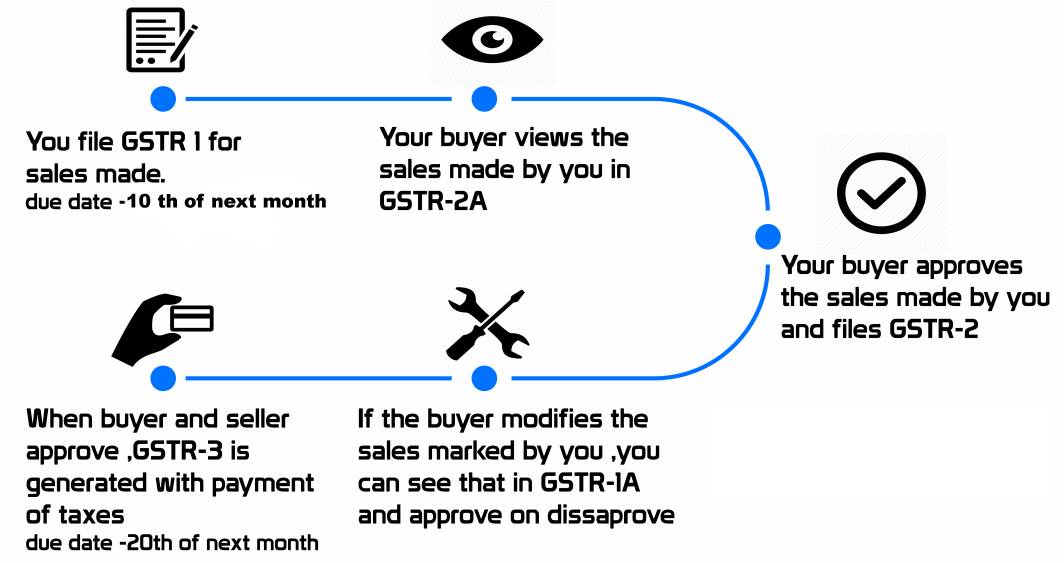

GST return filing process

Types of returns under GST

There are multiple return under the GST regime. The most common used return will be GSTR 1, 2 ,3, 4 & 9. GSTR 1, GSTR 2 & GSTR 3 will be submitted by all businesses on a monthly basis. GSTR 4 is submitted on a quarterly basis and GSTR 9 on an annual basis.

| Return/Form | Details | Frequency | Due Date |

|---|---|---|---|

| GSTR-1 | Outward sales by business | Monthly | 10th of next month |

| GSTR-2 | Purchases made by Business | Monthly | 15th of next month |

| GSTR-3 | GST monthly return along with the payment of amount of tax | Monthly | 20th of next month |

| GSTR-4 | Quarterly return for GST | Quarterly | 18th of month next quarter |

| GSTR-5 | Periodic return by Non-Resident foreign taxpayer | Monthly | 20th of next month |

| GSTR-6 | Return for Input Service Distributor (ISD). | Monthly | 15th of next month |

| GSTR-7 | GST Return for TDS | Monthly | 10th of next month |

| GSTR-8 | GST return for ecommerce suppliers | Monthly | 10th of next month |

| GSTR-9 | GST Annual Return | Annually | 31st Dec of next financial year |